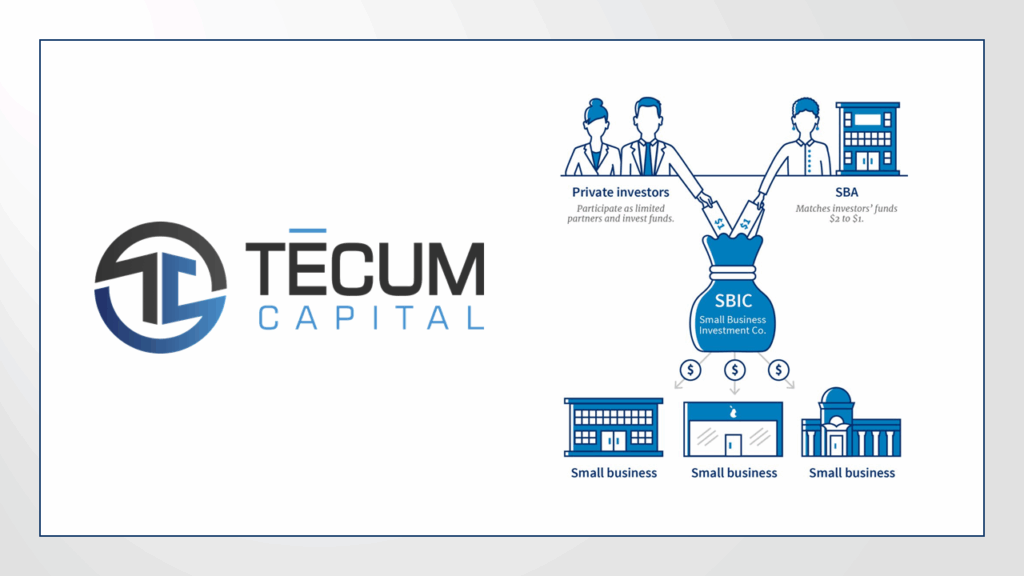

PITTSBURGH, PA —Tecum Capital Management, Inc, an investment firm based in Pittsburgh, Pa., today announced it received a license from the U.S. Small Business Administration (SBA) to operate its fourth SBIC (Small Business Investment Company) fund and recently held its fourth closing for the new fund, bringing the total fund size over$325 million. Tecum’s newest SBIC fund, Tecum Capital Partners IV, L.P., will continue the strategies of its prior SBIC funds by making mezzanine loans and minority equity investments across many industries.

“This fourth SBIC license is a significant milestone for Tecum Capital as it will accelerate our long-term growth plans,” said Stephen J. Gurgovits, Jr., managing partner of Tecum Capital Partners. “This new fund continues our primary investment strategy to provide strategic, long-term debt and equity capital solutions for lower middle market companies.”

With a strong interest in Rust Belt states as well as the Midwest, Southeast, and Mid-Atlantic regions, the team at Tecum Capital supports independent sponsors, family offices, private equity funds, and management teams to facilitate recapitalizations, buyouts, generational transitions, acquisitions, and other growth capital needs. “Through strategic guidance and operational improvements, Tecum Capital offers an attractive partnership for our portfolio companies. Tecum is Latin for ‘with you’, and relationship investing is a key driver of our business,” Gurgovits said. Over the last twelve years under its prior funds, Tecum Capital saw the total employee count of its portfolio companies increase by 42% from 11,258 to 16,034.

The average investment size for the new fund will be $5 million to $20 million per transaction. “Our investment criteria remain consistent with our predecessor SBIC funds,” said Gurgovits. “We are targeting the same size companies using the same proven strategies. Our investment philosophy is driven by a seasoned team at Tecum Capital, which creates a strong value proposition for our investors and clients.” The investor base of the new fund includes many of the existing limited partners, along with several new institutional investors, including several new banks.

Originally launched as a wholly-owned subsidiary of its former bank parent company in 2005, the Tecum Capital team spun out and formed its first SBIC fund in 2013. Along with Gurgovits, the firm’s original founding partners include Matthew L.T. Harnett and Tyson S. Smith, all of whom continue to provide leadership to Tecum Capital’s 16 employees.

Tecum Capital Partners IV is a $325 million pooled fund of committed capital licensed by the SBA as an SBIC. The fund is managed by Tecum Capital Management, a private investment firm, which invests in mezzanine debt, subordinated notes, private equity and other securities issued by small- and medium-sized commercial enterprises. The firm is focused on providing financing for recapitalizations, buyouts, generational transitions, mergers and acquisitions, and other growth capital needs. The Tecum Capital team will work with financial buyers, independent sponsors, management teams, and/or family offices with its investments. Tecum Capital is headquartered in Pittsburgh, PA, with a geographic footprint that extends across the United States, with a focus on the Midwest, Southeast, and Mid-Atlantic regions. For more information, please visit www.tecum.com.

About Tecum Capital Management, Inc.

Tecum Capital Management, Inc. (“Tecum”) is a Pittsburgh, Pennsylvania-based private investment firm deploying capital in lower middle market companies. Tecum provides mezzanine debt and equity investments in growth-oriented middle-market companies across many industries, including manufacturing, value-added distribution, and business services. Our team partners with independent sponsors, family offices, committed funds, business owners seeking succession plans, and management teams to create shared success. Tecum focuses on businesses with EBITDA greater than $3 million and will invest $5 million to $20 million in potential portfolio companies. Tecum manages three Small Business Investment Company (“SBIC”) licensed funds and is currently investing out of Tecum Capital Partners IV, L.P., a $325 million fund launched in February 2025. Tecum also manages a separate micro-cap equity control strategy via a multi-family office strategy with investment criteria encompassing EBITDA of $2 million to $6 million called Tecum Equity Alpha Management (“TEAM”). Since 2006, the team has collectively invested more than $1.0 billion in over 100 platform and add-on acquisitions.